Benefit Revolution

Free Market Solutions for Employee Benefits and Human Resources

Monday, April 8, 2024

Friday, March 22, 2024

I’m Coming Home

Today, with the greatest sense of professional pride I’ve ever had, I announce that I’ve come home to where I belong and where I will finish my career. I’ve been in benefits full-time for 22 years (32 years if you add part-time work after high school, during college, and in law school). Since 2002, I forged unimaginably rewarding and life-changing bonds with clients, teammates, and vendor partners.

Unfortunately,

also during that time, the underlying businesses housing my team’s efforts were

sold. Each time, this corporate

shuffling resulted in a larger, more bureaucratic, and an entity less aligned

with our values. Liberty Benefit sold to

BB&T, which then merged with Sun Trust to form Truist and rebrand and

reshape their hundreds of insurance agencies as McGriff.

Culturally,

philosophically, and at the deepest levels of intrinsic motivation, these

entities became further and further removed from my mission and purpose:

To provide businesses with the most cost-effective, innovative,

and high-quality employee benefit plans while simultaneously helping them

manage their risk and compliance and treating every dollar as though it is the

last an employee can afford to pay for care.

I wrote that

in 2004, and it has been my North Star ever since. Regrettably, often the larger an organization

grows, the further it removes itself from such a mission. Stock prices, shareholder demands, quarterly

growth, EBITA, and a pursuit of new sales at all costs are not conducive to

making sure each client continues to receive exactly what it needs – even if

they were last year’s sale.

So, after

watching changes that did not align with my business values take over and then

seeing private equity swoop in, 2023 became a year of endless introspection,

prayer, and discussion with my wife. Something had to change.

With a heart full of pride, energy, and vigor, I announce today that I am the newest member of the Mahoney Group, a privately held and employee-owned organization with no interest in Wall Street’s stock prices or private equity. As I restart my career at 50 years old, I am now brimming with joy.

I used to

think I wanted to retire between 50 and 55.

Now, I chuckle at that assessment. The kids are grown and on their own. My youthful exuberance to hunt, fish, bike,

and backpack is still there, but only as a hobby—not an all-consuming addiction.

No. I know

where I can make the biggest impact, and that is by providing businesses with

the most cost-effective, innovative, and high-quality employee benefit plans

while simultaneously helping them manage their risk and compliance and treating

every dollar as though it is the last one an employee can afford to pay for

care.

In so doing,

my new teammates at the Mahoney Group and I will fight doggedly to ensure you

are not being taken advantage of by a deeply flawed healthcare delivery

system.

On we

march!

Craig

Gottwals

Tuesday, January 2, 2024

Wednesday, December 20, 2023

On Armstrong and Getty for a Couple Hours This Morning

7 AM Hour - Just a Wee Bit Less Dynamic: features our guest, Craig, the Obamacare Guru, who joins Jack to discuss...

- The escalation of Christmas...

- The Trump/Colorado ruling...

- Jack's confrontation conundrum...

- Immigration...

- Those magical family moments!

- The Trump/Colorado decision...

- Weight Loss Drugs...

- The Ukraine/Russia War.

- Expert military analyst Mike Lyons joins the show to talk about the Israel/Hamas war.

Friday, September 15, 2023

Healthcare's Final Frontier: Navigating the Wild West of RBP with Industry Renegades

Omar Arif of ClaimDOC & Scott Schnaidt of HST on All Things RBP

Unveil a world where only 3-4% of employers dare to tread, but where jaw-dropping 30-40% savings rain like gold and concierge-level service is the sheriff in town.

Curious about RBP's magic? This isn't just healthcare. It's "Health-FAIR!" Here, employers "price-match" medical costs against benchmark prices, slicing their claims in half compared to big insurers.

Projections say employer healthcare costs will shoot up another 7-9% in 2024. Yet Medicare Part D Premiums are projected to decrease by 1.8%. All major insurers participate in both markets. The lesson? Employers with private insurance are subsidizing Medicare. But hold your horses. With RBP, brace yourself for a 0-2% trend that turns the tables on traditional care.

Jump into this roller-coaster ride of a podcast with your guide through this maze, joined by two titans of the trade—Omar Arif of ClaimDOC & Scott Schnaidt of HST. They've both cracked the code, each in their unique ways, and the results? Nothing short of spellbinding.

🎯 What's on Tap:

- The gears and levers behind RBP

- Navigating the legal minefields

- Secrets from Third-Party Administrators (TPAs)

- RBP's performance across the geographical board

- The art of handling balance bill claims

- Litigation: When & How Often

- Co-fiduciaries: The real deal or just smoke and mirrors?

- Show Me the Money: Their pay structure dissected

- Year-end Report Cards: The Good, the Bad, and the Profitable

Lock in your earbuds. Prepare for a mind-bending journey. You’re entering "The Repricers"—Healthcare’s Final Frontier! 🌌🛸

Saturday, September 2, 2023

The U.S. Will Finally Start Negotiating Drug Prices with Armstrong and Getty

I spent one morning this week chatting with Armstrong and Getty regarding the news that the federal government will finally begin negotiating the price of drugs. 10 of them. Two and a half years from now.

Well, it's a start...

Tuesday, August 8, 2023

It's A Government Healthcare Complex: Craig Gottwals Talks To A&G

Your health insurance costs and premiums have skyrocketed compared to the rate of inflation since Obamacare passed. Meanwhile, insurance carrier stock prices have grown by 1900% in the same timeframe.

"They're making unimaginable amounts of money... off of you." -Joe Getty

Craig Gottwals, aka "Craig the Healthcare Guru,” talks about that and more in a new episode of A&G's Extra Large Podcast.

Listen to the Armstrong & Getty Extra Large Podcasts featuring Craig.

Originally posted here.

Saturday, July 15, 2023

Required Leave for Any Reason, Ozempic, and Coverage for Gender Affirming Care

Tools & Webinars:

- McGriff's 2023 Benefits Survey Results

- McGriff's Quarterly Pharmacy Newsletter: covering Diabetes, obesity, and new weight loss drugs.

- Trending Topics in Retirement Webinar on July 27th

- In case you missed it, the July It Benefits You Newsletter

- Our Monthly Mineral Demonstration - robust web-based resource with live advisors, reliable content, and interactive technology solutions that provide an end-to-end People Risk Management solution

Compliance News:

Pharmacies are Sharing Sensitive Health Data with Facebook - "Looking for an at-home HIV or Plan B test on CVS’ website is not as private an experience as one might think, and CVS is not the only pharmacy sharing this kind of sensitive health data, according to a KFF Health News investigation. We found trackers collecting browsing- and purchase-related data on websites of 12 of the U.S.’ biggest drugstores, including grocery store chains with pharmacies, and sharing the sensitive information with companies like Meta (formerly Facebook); Google, through its advertising and analytics products; and Microsoft, through its search engine, Bing."

The IRS recently issued Notice 2023-37 to update its guidance for high deductible health plans (HDHPs) on expenses related to COVID-19 testing and treatment. The notice also clarifies whether certain items and services are treated as preventive care under the tax rules for HDHPs, and confirms that for plan years ending after Dec. 31, 2024, an HDHP is not permitted to provide benefits for COVID-19 testing and treatment without a deductible.

Open Issue: Employer-Sponsored Health Plans and Coverage of Gender-Affirming Care

June 28, 2023 – Jackson Lewis P.C.

Whether an employer-sponsored health plan must cover gender-affirming care is often dependent on whether the employer’s health plan is fully-insured or self-insured; fully-insured plans must provide gender-affirming care to the extent required by applicable state and federal law, while the law on categorical exclusions for gender-affirming care in self-insured plans continues to develop.

Talk about an FMLA leave headache! This one was a migraine

June 27, 2023 – HR Morning

A federal appeals court rejected claims filed by terminated employees who sought FMLA leave along with many others, ruling that the employer had good reason to believe the employees acted dishonestly and sought leave for an improper purpose. Employers can also take away from this article a few tips to curb FMLA leave abuse.

July Is the New January: The Pace of New State Laws Heats Up

June 26, 2023 – Littler Mendelson P.C.

This article offers insight into an array of labor and employment laws and ordinances from across the country, state by state, that take effect mid-year and will implicate employers’ compliance obligations.

New Trend in State Laws, Paid Leave for Any Reason - "In May 2019, Maine became the first state in the nation to require private employers to provide paid leave for any reason when Gov. Janet Mills (D) signed LD 369. Nevada followed a month later, in June 2019, when then-Gov. Steve Sisolak (D) signed SB 312, which also granted paid leave for any reason. Illinois is poised to join their ranks on January 1, 2024. In March 2023, Gov. J.B. Pritzker (D) signed SB 208, which says that beginning on January 1, 2024, private employers must offer their workers five days paid time off for any reason after they’ve completed a 90-day probation period."

- In Nevada, for example, Employers may limit the use of paid leave to 40 total hours per benefit year and may prevent an employee from using any accrued paid leave until the employee reaches their 90th day of employment. Employers may also set minimum increments of paid leave which an employee may elect to use, so long as that limit does not exceed 4 hours.

Benefits News:

A Couple Retiring in 2023 Needs $315,000 in Retirement Savings Just to Cover Medical Expenses in Addition to Medicare - "The after-tax cost for medical expenses throughout retirement for a single, 65-year-old retiree held steady at $157,500 ($315,000 for the average retired couple at the same age), according to the new 2023 Retiree Health Care Cost Estimate, which tracks retiree healthcare expenses annually."

Renewals Not Looking Good for UHC Clients: "UnitedHealth Group extended its streak as the most profitable company among major national insurers in the first quarter of 2023, reporting $5.6 billion in earnings. By comparison, fellow healthcare giant CVS Health reported the second-highest profit in the quarter at $2.1 billion, less than half of UnitedHealth's haul. CVS' profit also declined year over year, as it posted nearly $2.4 billion in the first quarter of 2022. UnitedHealth also takes the top spot on revenue for the quarter, reporting $91.3 billion. That's up from $80.1 billion in the prior-year quarter. CVS again lands at No. 2 on revenue, posting $85.3 billion."

Will the Doctor See You Now? The Health System's Changing Landscape - "About 48% of primary care physicians currently work in practices they do not own. Two-thirds of those doctors don’t work for other physicians but are employed by private equity investors or other corporate entities, according to data in the “Primary Care Chartbook,” which is collected and published by the Graham Center.... it now takes an average of 21 days just to get in to see a doctor of family medicine, defined as a subgroup of primary care, which includes general internists and pediatricians. Those physicians are many patients’ first stop for health care."

Health and Wellness:

Watch The Truth About Weight Loss Drug Ozempic with Dr. Peter Attia - a one-minute short.

Trusting The Science: The following is a list of the 20 largest settlements reached between the United States Department of Justice and pharmaceutical companies from 1991 to 2012 - Pfizer claims the largest criminal fine in U.S. history, while GlaxoSmithKline holds the largest pharma-fine in history when combining civil and criminal penalties.

What you need to know about Ozempic & Mounjaro - "But I want all my patients and the public to know that the appetite and weight loss effects do not last forever. Effects on hunger, cravings control, sweet cravings, mood & fullness are TEMPORARY and return to baseline between years 1 & 2. This was shown in surveys taken from patients using the medication over the long term."

Just 3% of adults show no major health risk factors linked to death - "Overall, most of us have something wrong with us, and we’re more likely to have a lifestyle health-risk factor now than in the ’80s and that’s actually associated with even greater mortality risk now than before."

Ozempic, Weight-Loss Drugs Probed Over Reports of Suicidal Thoughts - "Novo Nordisk A/S’s weight-loss medications are under investigation by the European Union’s drugs regulator after a small number of reports of suicidal risks were referred to the watchdog. The European Medicines Agency is looking at adverse events noted by the Icelandic Medicines Agency, including two cases of suicidal thoughts linked to the drugs Saxenda and Ozempic, the EMA said in a statement Monday."

Monday, June 19, 2023

This Week In Red Pilled Healthcare News

- Not worried about the fiduciary obligation to keep costs as low as reasonable? This firm looks for employers to sue on this very topic: "His law firm, Schlichter Bogard, LLC., recently posted advertisements looking for employees and potential plaintiffs at Target, State Farm, Nordstrom, and Pet Smart. They seek “current employees who have participated in the company’s healthcare plan.”

- What should be the first step in the management and oversight of any health plan? Well, as Dr. John Abramson of Harvard Medical School writes, "The first step is to give up the illusion that the primary purpose of modern medical research is to improve Americans’ health most effectively and efficiently. In our opinion, the primary purpose of commercially funded clinical research is to maximize financial return on investment, not health."

Monday, May 22, 2023

HR’s Porta-Potty Predicament: California Compliance Chaos

From Armchair Lawyer to Bathroom Auditor. A Peculiar Friday at the Office

In the late afternoon on Friday, at the brim of the weekend, my phone shrieked with a call of urgency. It was from a client named Nancy, who, with an audible eye-roll, launched into an account of her current predicament. Here's a condensed retelling of our dialogue.

“Craig, we have a pressing compliance concern that needs an immediate solution. Regrettably, it's not tied to benefits, but I’m betting you might be of assistance.”

“Consider it done, Nancy. I'm all ears.” ...

The full story is on my Substack.

Friday, May 12, 2023

Saturday, May 6, 2023

Employers Needlessly Overpay 224% for Healthcare

This week in the government-healthcare complex's

gluttonous plundering of U.S. business, we saw that:

- Cigna posted $1.3 billion in Q1 profit on the heels of learning

that Cigna saves millions by having its doctors reject

claims without reading them; and

- UnitedHealthcare lost a 91 million dollar suit for

chronic underpayment and unjust claim denials.

I read stories like this every week and become increasingly enraged at the cruel injustice of it.

We Already Have a Socialized

System

The latest studies on the topic show that the American

taxpayer funds 71% of all healthcare in blue states like California. That leaves 29% of healthcare costs funded by

folks paying their own way to pay 224% of what the healthcare industry's

largest customer (the federal government, primarily via Medicare and Medicaid)

pays for the same procedures at the same facilities. Still think that the healthcare you receive

at work is not taxed?

The rampant fraud riddling American healthcare boggles my mind. No, I'm not talking about the

fact that one of every three dollars spent in the Medicare and Medicaid system

is squandered on waste, fraud, or abuse (1). Nor am I lamenting how America's largest

purely socialized system, the Veteran's Administration, is so indifferent to

our veteran's needs that it creates fake appointments at nonexistent clinics so it can show auditors that the wait times and abject

patient neglect are not as they indeed are.

I'm also not referring to how and why you overpay for prescriptions by

at least 25% to 50%. Pharmacy

benefits are a treasure trove of corrupt pricing, hidden rebates, and shell

games that would expand this post beyond a reasonable length (2).

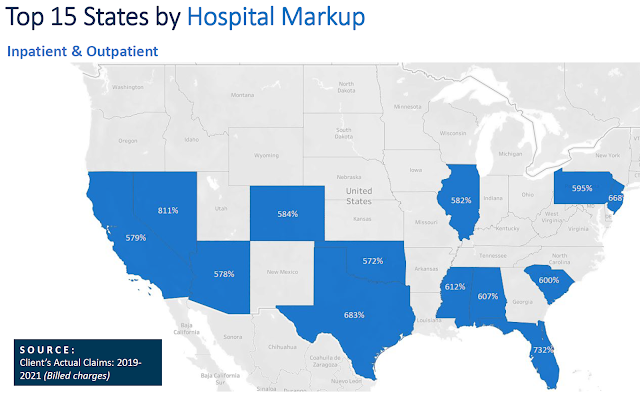

Instead, I'm talking about the gargantuan tax every

employer and employee (3) pays for the "privilege"

of buying commercial health insurance through the workplace. Because Medicare and Medicaid pay

facilities (4) so meagerly for services, hospitals respond by listing retail

or chargemaster prices that are three, four, five, or even ten times as high

for the same procedures at the same facilities.

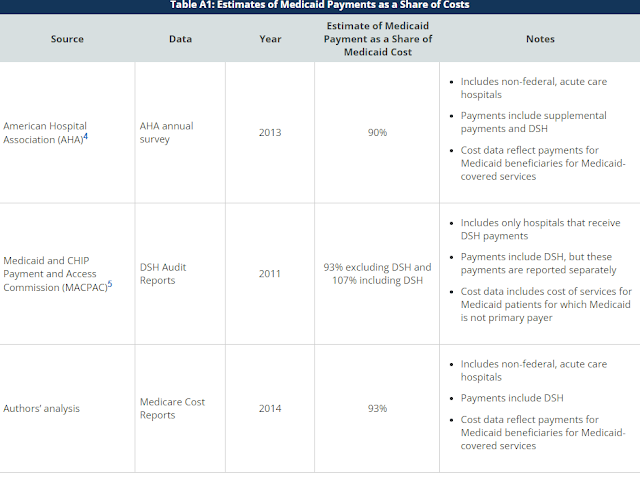

Below is a 2016 summary of cost data on Medicaid (for low-income) showing that, on average, Medicaid may not even cover the actual cost of

providing services. Generally, Medicare (for the elderly) pays a little better than this in most states.

Your health insurer then negotiates a 50% discount on

that completely phony "price" the facility claims through its

chargemaster in the hopes that employers and employees will be mollified by the

seemingly considerable discount they receive for the privilege of having a

private plan. In the end, private payers

pay a national average of 224% of Medicare and as high as 600% of a hospital's

cost in a state like California.

Does your business get to mark up its products by

600%?

Additionally, those with self-funded plans know that

you are also paying $20 per employee per month for that privilege of getting a

50% discount on a claim that's been fraudulently priced at 500% of Medicare. It is what Dave Chase, writing at Forbes, hypothesized might be "The Greatest Heist In American History."

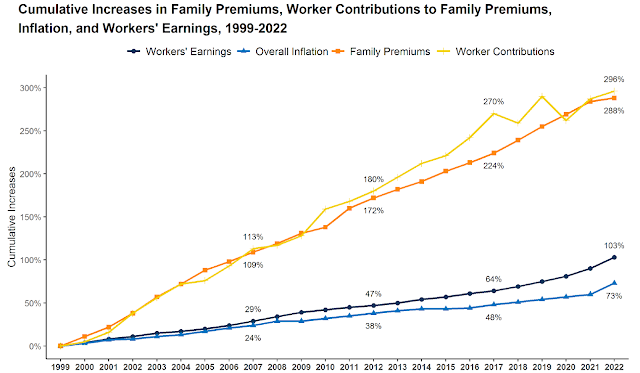

Obamacare was going to fix this, right? Remember when President Obama stood in front of cameras and told us, tens of times, that the cost of healthcare was going to godown by $2,500 per family?

Here is what that government promise of a $2,500 reduction in family premiums looks like in real life. It is the orange line below. See the massive drop in 2010 and the continued drop over time? Neither do I.

Source: KFF Employer Health Benefits Survey, 2018-2022.

But certainly, our fearless government leaders finally reined in the obscene carrier profits in order to protect the little guy with the passage of ObamaCare, right? Not so much.

- Since 2009 the S&P 500 is up 422%.

- In that same time, five of the largest health insurer stock prices are up an average of 1,921%.

Source: Yahoo Finance.

Okay, enough of this. I cannot stomach another fact in this vein.

Employers, There is Another Way

Three Steps to a 40%

Cost Reduction - A HealthCost Revolution

Step 1: if you are too small to engage in any form of self-funding

or partial self-funding, buy as little insurance as possible. The more premium you pay, the more you are

pilfered. You have to get out of that

game. Purchase the highest-priced

deductible plan your insurer offers, then self-fund the amount under that

deductible with a Health Savings Account (HSA) or Health Reimbursement Account

(HRA). If you have less than about 250

employees, depending on your cash flow, industry, and geographic locations,

this might be the best you can do.

Step 2: If you have more than about 250 employees, you

should evaluate whether you can opt out of this fraud entirely, say goodbye to

your insurers, and move to a reference-based pricing (RBP) system whereby you

pay some reasonable margin over the Medicare price. For example, you might pay 120% to 140% of

Medicare. It fundamentally works, is

legally quite creative and astute, and will provide your employees with better

benefits, lower costs, and more freedom.

Is the first step intimidating, potentially rocky, and

one that requires plenty of education? Yes. But making this move will reduce the cost of

your health plan by 20% to 40%.

I wrote about how this will be the only mechanism that

has a meaningful chance of saving private healthcare in America back in 2020

here: America will dramatically change the way it provides health care by 2030

I recently wrote about the financial imperative of

evaluating this process now, here: The fiduciary imperative of reference-based pricing: A legal and financial

analysis.

And I was

recently interviewed on the Armstrong and Getty Radio program, discussing this here.

Step 3: In

conjunction with your move to a self-funded RBP platform, you then must also

take control of your pharmacy coverage via a direct contract with a pharmacy

benefit manager (PBM) or one of the newer consortiums that aggregate numerous

employers under one set of contract terms to maximize the pharmacy discounts

and rebates for you, not an insurer.

This move alone reduces your pharmacy bill by 25% to 50%.

If

your broker is not talking to you about what I call the HealthCost

Revolution of:

- Getting off of first-dollar insurance plans (i.e. moving to HRAs or HSAs);

- Evaluating RBP; and

- Getting your Rx out of the carrier world and into a direct PBM contract...

You need to fire them. Period. Hard stop.

I've been an attorney for 23 years and a full-time insurance broker for 21. The required education and licensing for brokers are hysterically ludicrous. In most states, it takes a one-week course and a junior-high education to become a licensed broker. Carrier influence dominates that process as agents-to-be are taught that they have an equal obligation to their carrier and policyholder. Future agents are trained that this is some sort of collaborative cuddle fest in which carriers, employers, and employees all sit around campfires, roast marshmallows, hold hands and sing Kumbaya.

Oof. I need to step away for a bit. Why do I insist on making myself so sick?

I recently created this meme for my team members after a carrier emailed us, explaining that the carrier did not expect me or my team to market my employer's policy this year, as asking for quotes every year is not the "best way to proceed."

Ha!

Best for whom?

Yes, they are that brazen. They do not partner with you and are not your friends. Their job is to maximize revenue, and that means maximizing your premium.

Here is the reality. Every one of those three steps in the HealthCost Revolution reduces premiums and adds heaping piles of work to your broker's plate. The broker will be giving themselves a pay cut while requiring much more work and expertise. In fact, probably only about 5% to 10% of brokers in the West are qualified to install and manage a self-funded plan, as HMOs have been so dominant in the West that few brokers have had the opportunity to learn what they need to effectively manage this process.

I can hear some of you out there saying, "That's why we don't pay our broker a commission; she is on a fee basis."

To this, I respond, okay, great. At best, you've capped their pay and will be asking them to do much more work to install this protocol. Most likely, you are paying your broker a fee and allowing your carriers to also collect the commission that should be going to your broker. Yep, Obamacare created that double-dip trap as well. I wrote how and why that happened years ago here.

As a lawyer, my training is to protect my client (policyholder) in all cases. I scoff at the "equal duty to carrier and employer drivel" and act solely as my employer's advocate. Asking a broker to be the prosecutor, public defender, and judge in one proceeding is a bad joke.

Our healthcare system is a convoluted, byzantine myriad of corruption. I cannot stand by and refrain from screaming from the rooftop. Don't get me wrong. There are plenty of fantastic people in the healthcare system. In fact, I know that the vast majority of them are there for the right reasons. They want to help people.

But even good people cannot save a corrupt system.

That's

right; it’s corrupt. I used to say it

was broken, but it is not. It is

designed this way. We didn't end up here

by accident. If you doubt me, let me

repeat:

- Since 2009 the S&P 500 is up 422%.

- In that same time, five of the largest health insurer stock prices

are up an average of 1,921%.

The healthcare industry represents the largest employer and the largest lobbyist in the United States, spending $700 million lobbying legislators and regulators every year. It makes up 18.2% of the U.S. economy. At its highest levels, it is loaded with the shrewdest operators you can imagine. It uses artificial intelligence and massive data analytic tools to vacuum up every conceivable detail about every one of us, as I recently wrote about here: WeaponizingHIPAA privacy.

Furthermore, it is important to note that officials responsible for managing federal agencies tasked with supervising the United States healthcare system frequently transition from their governmental positions to leading roles in the very corporations they once regulated. The term for this phenomenon is "revolving door," which refers to the movement of government officials between public sector roles and private sector positions, often within industries they previously regulated. This repugnant twist enables them to capitalize on their expertise, influence peddling, and skillfully manipulate the governance system for the benefit of their new employers. Recently, The Survival Podcast highlighted this phenomenon through a thought-provoking illustration. Employing humor as a coping mechanism for such prevalent absurdity is essential; without the ability to find levity in these situations, I’d struggle to maintain my sanity.

|

| A light-hearted look at the most recent Revolving Door “swingers.” For a sobering look at the hundreds of these taking place in D.C. visit Open Secrets. |

In summary, it is crucial to understand that health insurers do not serve as your friends or allies. When Chief Financial Officers delegate the responsibility of managing health insurance expenses—which frequently rank as the second or third largest cost for employers—to Human Resources departments, they are neglecting their fiduciary duty to minimize costs in a reasonable manner. Human Resources professionals typically lack the legal expertise of attorneys and the financial acumen of finance executives, which further underscores the importance of involving the appropriate personnel in managing these critical expenses.

It is imperative that American businesses take decisive action to reduce healthcare costs by utilizing the innovative tools at their disposal and engaging the most competent consultants or brokers to aid them in this process. Failure to do so could result in the collapse of the employer-based healthcare system, leading to the implementation of a minimal, Medicaid-for-all arrangement. Under such a system, individuals with the means would acquire supplementary coverage, while those without would face extended wait times for necessary care and elective procedures. This will, in turn, prompt the departure of more top-tier providers from the system (5).

It is essential to emphasize that this scenario envisions Medicaid for all, rather than Medicare. Despite the government's willingness to employ quantitative easing measures, injecting trillions of dollars into the economy at a moment's notice, Medicare remains prohibitively expensive—even for a nation with a $32 trillion debt and no hesitation to take on more.

Concluding on a lighthearted note, I would like to share two more memes. As the adage suggests, "A picture is worth a thousand words," so allow me to present an additional 2,000 words of insight.

Footnotes:

(1) Malcolm K.

Sparrow, a professor at the Kennedy School of Government at Harvard

University whose book License to Steal is a classic in the field, thinks that Medicare’s

fraud-related losses may run “as high as 30 to 35 percent” of its budget. From Chapter 12 in Overcharged: Why Americans Pay Too Much For Health Care, by David A. Hyman and Charles

Silver.

(2) The following is an excerpt from the same book. It is an anecdotal example of just how corrupt our prescription rules and practices are:

Why do so many eye

doctors use pricier Lucentis when cheaper Avastin is available? You guessed it:

Medicare pays physicians a lot more for using Lucentis. A 2013 Washington Post article explained the

finances.

Under Medicare repayment

rules for drugs given by physicians, they are reimbursed for the average price

of the drug plus 6 percent. That means a

drug with a higher price may be easier to sell to doctors than a cheaper one. In addition, Genentech offers rebates to

doctors who use large volumes of the more expensive drug.

Got that? Medicare pays

doctors far more for administering Lucentis than Avastin to patients with wet

macular degeneration because Genentech charges more for the former than the

latter. Six percent of $2,300 is $138; 6

percent of $60 will barely buy you a white chocolate mocha at Starbucks. Genentech then sweetens the deal by giving

doctors who use large amounts of Lucentis discounts that the doctors get to

keep. It’s easy to see how Medicare put

taxpayers and seniors on the hook for $1.2 billion in payments for Lucentis in

2012. The hard part is explaining why

many doctors, to their credit, continue to use Avastin. The cost to taxpayers and elderly patients

could be much higher.

(3) I write "employer and employee" here to not confuse

folks needlessly while making a different point. But make no mistake; employees pay for every

nickel of this. We often fail to

acknowledge this reality because, on its face, an employer generally deducts

10% to 50% of our healthcare premium and then pays the rest of the bill to the

carrier monthly. However, every single

penny comes from an employee's compensation.

If the employer were not forced to fund those dollars into healthcare,

that remuneration would be provided to employees in the form of pay, other

benefits, time off, or efficiencies resulting in job/employment growth, etc. This is covered expertly in Chapter 1 of

Marshall Allen's book, Never Pay the First Bill.

(4) The same phenomenon exists for providers (doctors) as well as facilities, but the problem with providers is not nearly as pronounced as it is with facilities. Roughly 80% of a plan's claims occur with providers, but 80% of costs are generated via the high-cost services occurring in facilities (primarily hospitals).

(5) America is projected to have a shortfall of 139,000 physicians by 2033, representing 13% of U.S. providers.